Equity Fund Investment Objective

Generate annual returns significantly higher than the S&P 500 index returns.

Question For Any Asset Manager: Can You Beat The S&P 500?

The way to win is to:

Be dynamic with cash allocation and borrowing from our broker.

Buy and sell individual S&P 500 equity names but no shorting.

Have strategies grounded in analytics.

Be Dynamic

You don’t always have to invest 100% of your cash, 100% of the time.

There are also times you want to borrow cash to buy more than 100% of your portfolio in other assets.

| Traditional Portfolio / S&P 500 |  |

|

| Week 1 |  |

|

| Week 2 |  |

|

| Week 3 |  |

|

| Week 4 |  |

|

- Stocks

- Cash

Note: The graph is a hypothetical illustration.

Dynamic But Keep Risk in Check

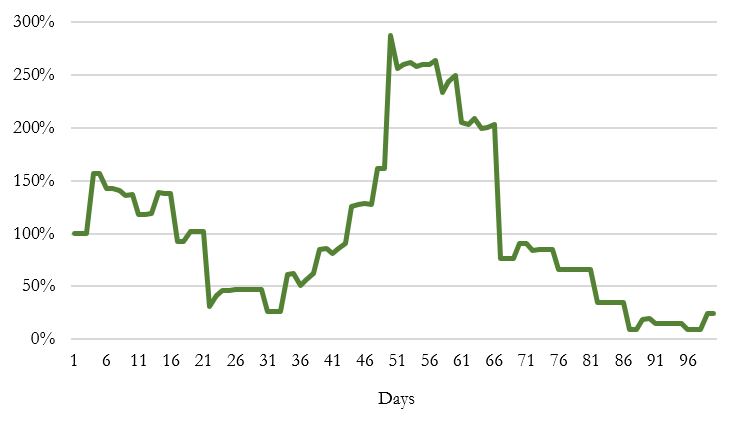

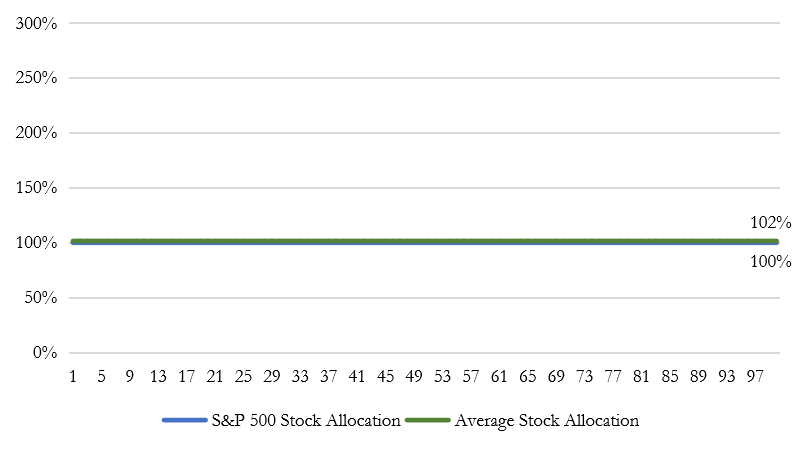

On any given day, the stock allocation could be between 0% and 300%, but the average stock allocation is close to 100%.

Daily Stock Allocation

Average Stock Allocation vs S&P 500

Notes: Graphs shown are for illustrative purposes. The stock allocation guideline is based on portfolio weights at initiation of positions and may be breached or adjusted at portfolio manager’s discretion.

Buy and Sell Individual Names

Time 1

- Z37 Positions

- Z177% Equity

Top 5

- $Biogen

- $Fleetcor Technologies

- $Eli Lilly

- $Arista Networks

- $Alphabet Inc. (Google)

Time 2

- Z7 Positions

- Z30% Equity

- Z70% Cash

Top 5

- $Target

- $Palo Alto Networks

- $Kroger

- $Becton Dickinson

- $Home Depot

Note: Portfolios shown are for illustrative purposes and do not reflect actual performance or constitute investment recommendations.

Have Strategies Grounded In Analytics

Investment strategies/algorithms are developed, balanced and executed in a process that is preserved in computer code.

Millions of data points are analysed daily.

Active trading ensures no stale positions and allows for the portfolio to process and adapt to new market information.

Approach is a blend of man and machine.

Note: Investment objective is gross of fees.