Opus Fund Investment Objective

Generate average annual returns of 15% to 30% with low correlation to broad indices over a full market cycle.

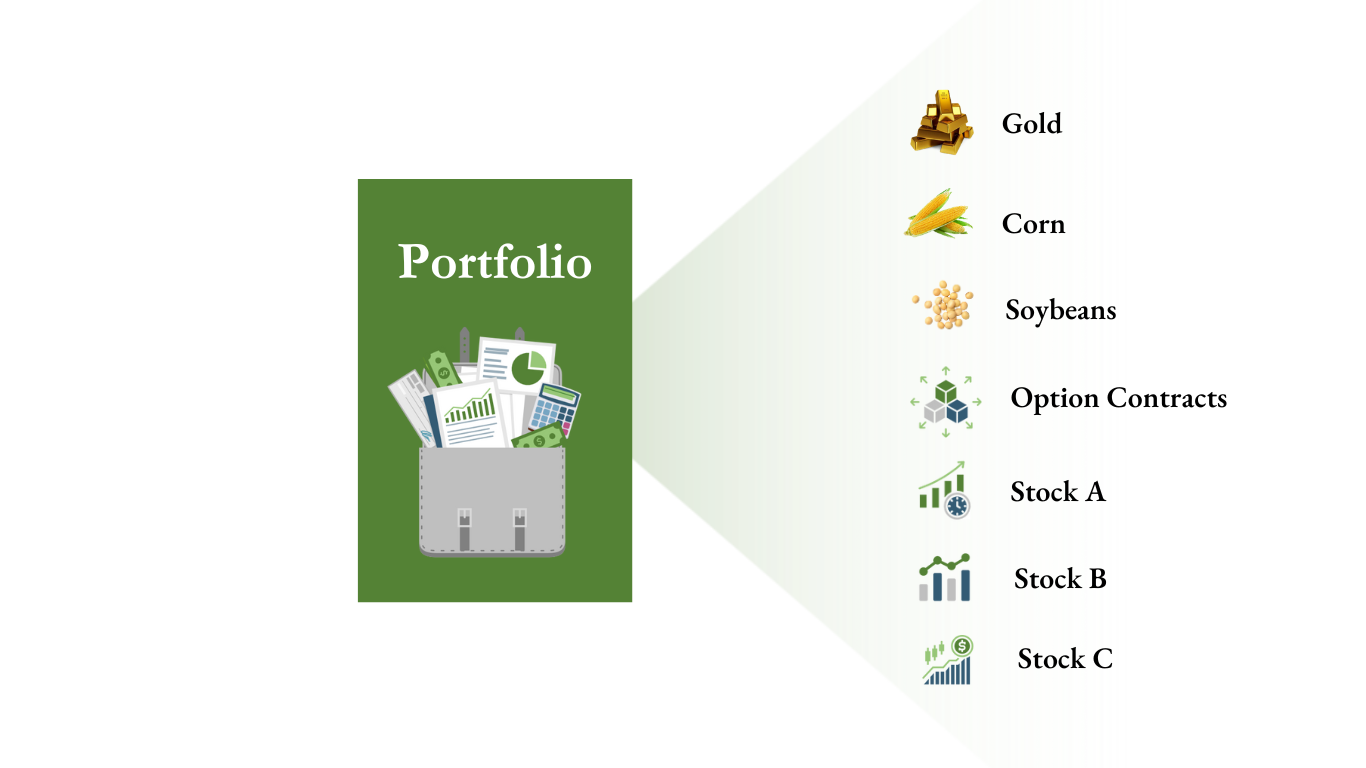

Investment Strategy Categories

Broad S&P 500 Market Timing Long/Short

Commodities

• Long/Short

• Dedicated Short

Options on Individual Stocks

Individual Stocks

• Short Term Long/Short

• Medium Term Long/Short, Sector Specific

• Medium Term Long-Biased

• Medium Term Market Neutral, Sector Specific

Volatility

• Market Timing Long/Short

• Market Timing Dedicated Short

Index Options

How Do We Do It?

- Invest in multiple asset classes: stocks, commodities, options, futures, volatility contracts, and ETFs.

- Invest in multiple investment strategies that have proven track records.

- Blend the asset classes and investment strategies to produce a harmonized portfolio return profile.

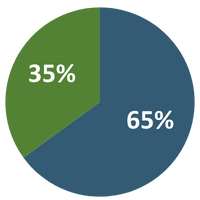

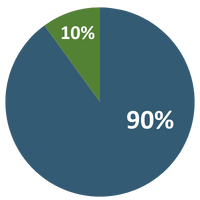

Diversify and Blend

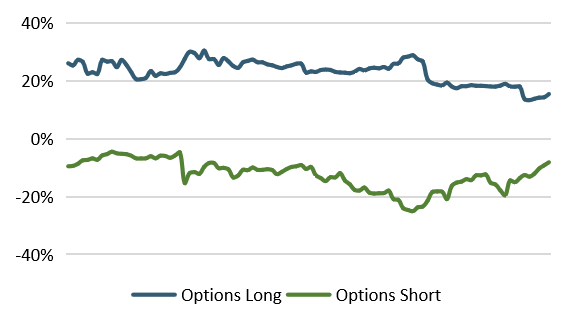

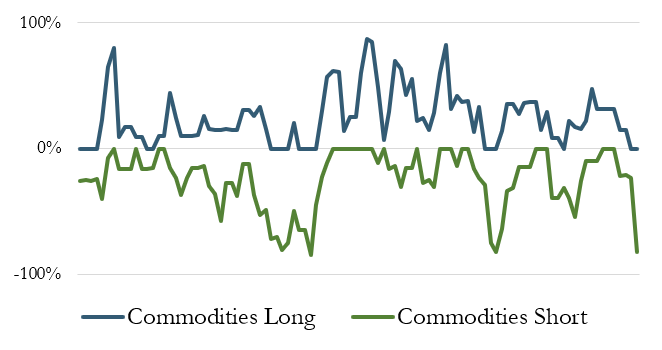

Go Long and Short

Notes: Graphs provided are for illustrative purposes.

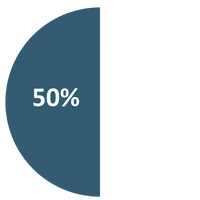

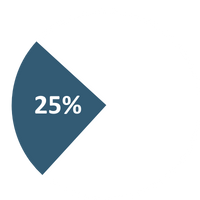

Be Dynamic

You don’t always have to invest 100% of your cash, 100% of the time.

There are also times you want to borrow cash to buy more than 100% of your portfolio in other assets.

| Traditional Portfolio / S&P 500 |  |

|

| Week 1 |  |

|

| Week 2 |  |

|

| Week 3 |  |

|

| Week 4 |  |

|

- Stocks & Other Assets

- Cash

Note: The graph is a hypothetical illustration.

Have Strategies Grounded In Analytics

Investment strategies/algorithms are developed, balanced and executed in a process that is preserved in computer code.

Millions of data points are analysed daily.

Active trading ensures no stale positions and allows for the portfolio to process and adapt to new market information.

Approach is a blend of man and machine.

Note: Investment objective is gross of fees.