Harmony 40 Portfolios

Balanced by Design, Enhanced by Alternatives

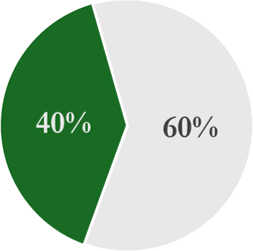

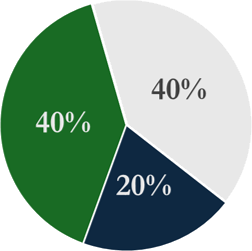

All Harmony 40 model portfolios allocate 40% to the Symphony One Hedge Funds and 60% to more traditional asset classes.

Symphony One Hedge Funds (40%)

Opus Fund (20%)

Investment Objective

Generate average annual returns of 15% to 30% with low correlation to broad indices over a full market cycle.

Equity Fund (20%)

Investment Objective

Generate annual returns significantly higher than the S&P 500 index annual returns.

Traditional Assets (60%)

Stocks

Bonds

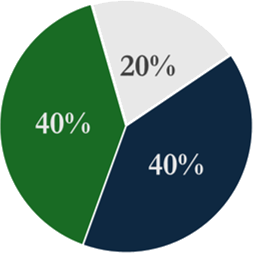

Harmony 40 Portfolios Allocation Options

Conservative

Balanced

Moderate Growth

Growth

- Symphony One Hedge Funds

- Bond ETFs

- Stock ETFs

Note: The allocations given for each asset class are guidelines and can be higher or lower at the portfolio manager’s discretion (including for the allocation to the Symphony One Hedge Funds).

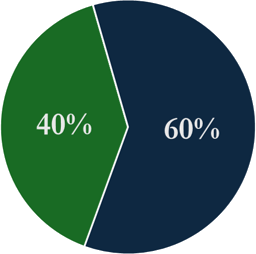

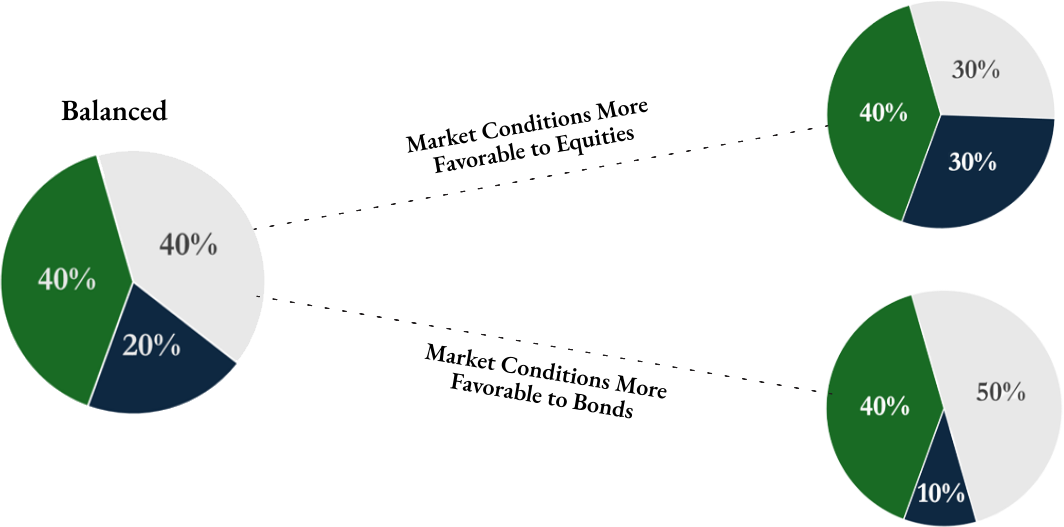

Harmony 40 Portfolios Strategic And Tactical

- Symphony One Hedge Funds

- Bond ETFs

- Stock ETFs

Note: The allocations given for each asset class are guidelines and can be higher or lower at the portfolio manager’s discretion (including for the allocation to the Symphony One Hedge Funds).